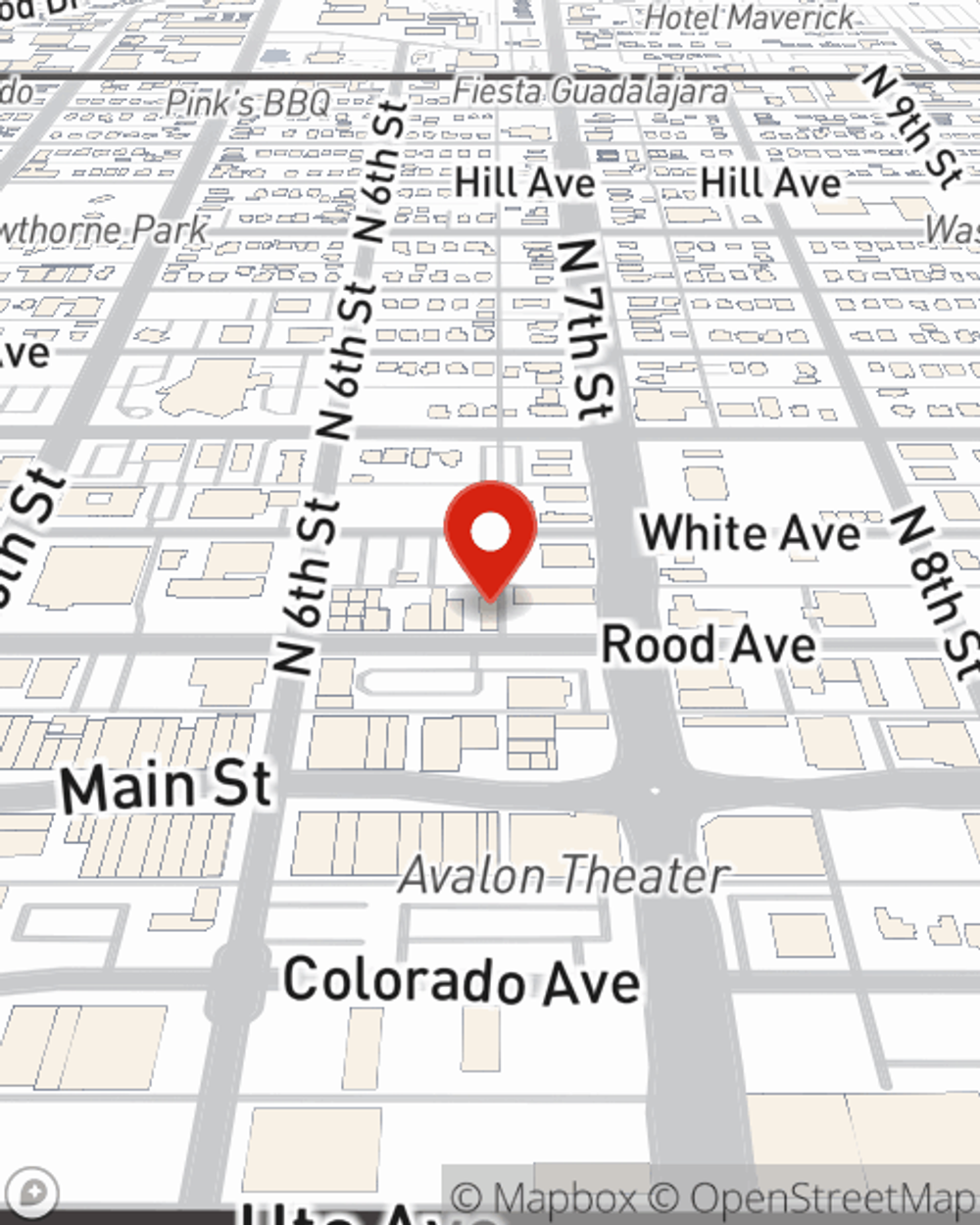

Life Insurance in and around Grand Junction

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Grand Junction

- Aurora

- Denver

- Pueblo

- Boulder

- Durango

- Montrose

- Ft Collins

- Colorado Springs

- Glenwood Springs

- Delta

- Rifle

- Fruita

- Telluride

It's Never Too Soon For Life Insurance

When facing the loss of a loved one or a family member, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and face life without the one you love.

Coverage for your loved ones' sake

Life happens. Don't wait.

State Farm Can Help You Rest Easy

The beneficiary designated in your Life insurance policy can help cover important living expenses for the ones you hold dear when you pass. The death benefit can help with things such as utility bills, home repair costs or house payments. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, responsible service.

Don’t let the unknown about your future make you unsettled. Call or email State Farm Agent Adam Hobbs today and discover how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Adam at (970) 248-9070 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.